Value Added Tax (VAT) is one of the most significant tax obligations for businesses operating in the United Kingdom. Whether you are a small business owner, a growing company, or an international organisation trading in the UK, understanding how VAT works is essential for compliance, cash flow management, and long-term financial stability.

At the centre of the UK VAT system lies a concept that often causes confusion: input VAT vs output VAT. These two terms form the foundation of how VAT is calculated, reported, and paid to HM Revenue & Customs (HMRC). Misunderstanding the difference between them can lead to incorrect VAT returns, unexpected tax bills, or even penalties following an HMRC inspection.

VAT in the UK operates as a consumption tax. While end consumers ultimately bear the cost, VAT-registered businesses act as intermediaries, collecting VAT on behalf of HMRC and reclaiming VAT incurred on eligible business expenses. This mechanism relies entirely on the correct identification and treatment of input VAT and output VAT.

In this comprehensive article, we will explain input VAT vs output VAT in clear, practical terms, using UK-specific rules and examples. You will learn how each type of VAT works, who pays it, how VAT liability is calculated, and what to consider when reclaiming VAT. We will also explore the role of tax ID and VAT number validation in maintaining global VAT compliance, particularly for businesses operating across borders.

This guide is intended as a cornerstone resource for UK VAT understanding, helping businesses make informed decisions while meeting their obligations under HMRC regulations.

Input VAT vs Output VAT: What Is The Difference?

Value added tax (VAT) is a type of consumption tax imposed on goods and services, functioning as an indirect tax on consumption rather than income or profits. It plays a significant role in business tax obligations, requiring businesses to account for VAT on their transactions.

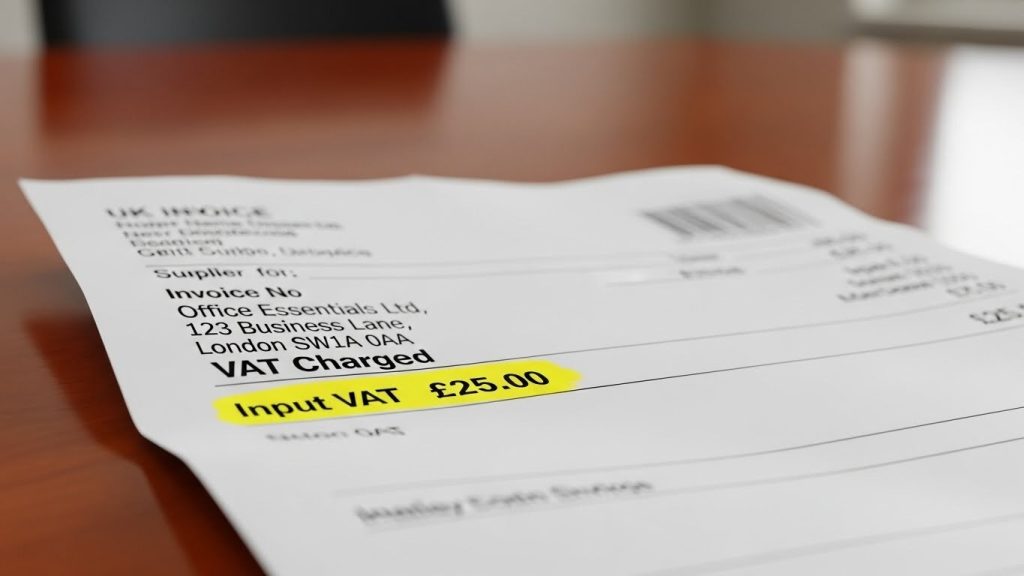

Input VAT is a fundamental concept within the UK VAT system and a key part of understanding input VAT vs output VAT. In simple terms, input VAT is the VAT that a VAT-registered business pays on goods and services purchased for business purposes. This VAT is charged by suppliers and included on valid VAT invoices. Input VAT is recorded as a Current Asset (VAT Receivable) on the balance sheet.

For UK businesses, input VAT represents the tax element of business expenses that may be recoverable from HMRC, provided certain conditions are met. Only eligible expenses that are related to the company’s activity and supported by proper documentation qualify for VAT deductions. Understanding what qualifies as input VAT vs output VAT, and when each one can be reclaimed, is essential for accurate VAT reporting and effective financial management.

What Is Input VAT in the UK?

Input VAT, also known as input tax, refers to the VAT incurred by a business when it buys goods or services that are used to make taxable supplies. These purchases may come from UK suppliers or, in some cases, overseas suppliers, depending on the nature of the transaction.

In the context of input VAT vs output VAT, input VAT (or input tax) is the VAT flowing into the business through its purchases, while output VAT flows out of the business when it charges customers. This distinction is central to how VAT liability is calculated on a VAT return.

Input VAT UK is typically shown separately on a VAT invoice and must meet HMRC’s invoicing requirements. A valid VAT invoice will include:

- The supplier’s VAT registration number

- The amount of VAT charged

- The VAT rate applied

- The total amount payable

Input VAT deduction is only possible if all documentation requirements are met. Tax authorities can reject an input VAT deduction if a proper VAT invoice is not provided, even if the expense itself is legitimate.

Common Examples of Input VAT

Input VAT can arise in many everyday business activities. Common examples include:

- VAT paid on office supplies such as stationery and equipment

- VAT on professional services, including accounting, legal, and consultancy fees

- VAT on software subscriptions, hosting services, and digital tools

- VAT paid on utilities such as electricity, gas, and water used for business purposes

By paying input VAT on these purchases, businesses can reclaim VAT from the government, provided the expenses are eligible and properly documented.

These scenarios often create confusion when assessing input VAT vs output VAT, particularly where VAT is accounted for but not physically paid to a supplier.

Input VAT and Business Expenses

Not all VAT paid by a business automatically qualifies as recoverable input VAT. HMRC requires that expenses must be incurred wholly or partly for business purposes. Where an expense has both business and private use, only the business-related portion of the VAT may be reclaimed. Additionally, only expenses related to taxable transactions are eligible for input VAT deduction.

Examples of mixed-use expenses include:

- Mobile phone contracts used for both business and personal calls

- Vehicles used privately as well as for business

- Home office expenses

In such cases, businesses must apply a fair and reasonable method of apportionment. Failure to do so may result in incorrect VAT claims and potential HMRC penalties.

When Input VAT Cannot Be Reclaimed

One of the most important aspects of understanding input VAT vs output VAT is recognising that not all input VAT is recoverable. HMRC blocks VAT recovery on certain categories of expenditure, regardless of business use.

Common examples of blocked or restricted input VAT include:

- Business entertainment costs, such as client hospitality

- VAT on goods or services used exclusively for private purposes

- Certain motor vehicle purchases, unless specific conditions are met

Additionally, businesses making exempt supplies may not be able to reclaim all of their input VAT. This is particularly relevant for partially exempt businesses, such as those operating in finance, education, or healthcare.

Record-Keeping and Input VAT Compliance

Accurate record-keeping is essential when dealing with input VAT. HMRC requires businesses to retain VAT records and invoices for at least six years. These records must clearly support any input VAT claims made on VAT returns. It is crucial to follow VAT rules and VAT regulations to ensure compliance and maximize reclaim opportunities.

Maintaining proper documentation not only ensures compliance but also strengthens a business’s position in the event of an HMRC audit. Errors relating to input VAT are among the most common issues identified during VAT inspections, especially where businesses misunderstand the rules governing input VAT vs output VAT.

For the year 2026, most businesses in the UK must maintain digital records of all VAT transactions under Making Tax Digital.

What Is Output VAT?

Output VAT, also known as output tax, is the counterpart to input VAT and forms the other half of the input VAT vs output VAT relationship. While input VAT relates to VAT paid on business purchases, output VAT UK is the one that a VAT-registered business charges to its customers on the sale of goods or services.

In the UK VAT system, businesses act as tax collectors on behalf of HMRC. Output VAT represents the VAT a business collects from customers and later reports and pays to HMRC through its VAT return, after deducting any eligible input VAT. Output VAT is collected by the business on behalf of the government and must be remitted to the tax authorities. It is recorded as a Current Liability (VAT Payable) on the balance sheet.

Definition of Output VAT in the UK

Output VAT is the VAT charged on taxable supplies made by a VAT-registered business. A taxable supply includes sales of goods or services subject to VAT at the standard, reduced, or zero rate along with certain deemed supplies, such as business assets taken for personal use.

When analysing input VAT vs output VAT, output VAT is the VAT flowing out of the business to HMRC, even though it is initially collected from customers. It is not business income and should never be treated as revenue in financial accounts.

Output VAT must be calculated correctly and shown on VAT invoices issued to customers. HMRC requires businesses to charge output VAT at the correct rate based on the nature of the supply and the place of supply rules, and to remit VAT to the relevant tax authorities. Businesses must be diligent in their accounting practices to ensure they remit the correct amount of output VAT and avoid penalties.

Examples of Output VAT

Output VAT arises in most day-to-day trading activities. Common examples include:

- VAT charged on goods sold within the UK

- VAT added to professional services, consultancy fees, or labour charges

- VAT on digital services supplied to UK customers

For example, if a UK VAT-registered business sells services for £10,000 plus VAT at the standard rate, it must charge £2,000 in output VAT. This £2,000 belongs to HMRC, not the business, and must be reported accordingly. The collected output VAT must be remitted to the tax authorities within the specified VAT period to ensure compliance and avoid penalties.

In international scenarios, output VAT may still apply depending on:

- The customer’s location

- Whether the customer is VAT-registered

- Whether the reverse charge mechanism applies

These rules often complicate the distinction between input VAT vs output VAT, particularly for businesses supplying services across borders.

Output VAT Rates in the UK

UK VAT law recognises several VAT rates, with updates in rates every year, and output VAT must be charged correctly based on these classifications:

Standard Rate (20%)Applies to most goods and services in the UK and accounts for the majority of output VAT charged by businesses.

Reduced Rate (5%)Applies to specific supplies such as domestic fuel and energy, and certain energy-saving materials.

Zero Rate (0%)Applies to items such as most food, children’s clothing, books, and exports. Although the VAT rate is zero, these supplies are still taxable and count as output VAT for VAT reporting purposes.

Exempt SuppliesCertain supplies, including financial services and insurance, are exempt from VAT. No output VAT is charged, but these supplies affect input VAT recovery.

Correctly identifying and applying the applicable VAT rate is essential for accurate VAT management and compliance. Charging the wrong VAT rate on invoices can result in underpaid VAT, interest charges, and penalties from HMRC. Additionally, tax authorities can reject an input VAT deduction if the VAT number is incorrect or the amount of VAT charged does not match the applicable VAT rate.

Output VAT and VAT Invoicing Requirements

HMRC imposes strict invoicing requirements for output VAT. VAT invoices must include:

- A unique invoice number

- The supplier’s VAT registration number

- The VAT rate applied

- The amount of output VAT charged

Only businesses with a valid VAT number have the right to charge and collect VAT. Customers should always verify the supplier’s VAT number to ensure compliance and proper VAT collection.

Failure to issue compliant VAT invoices may lead to disputes with customers and complications during VAT inspections. It also undermines accurate reporting of input VAT vs output VAT on VAT returns.

Output VAT and Business Cash Flow

Although output VAT is collected from customers, it can impact cash flow. Businesses may receive VAT from customers before they are required to pay VAT to HMRC, creating a temporary cash flow advantage. However, the obligation to pay VAT to HMRC after collecting it from customers means that the timing of these payments is crucial for effective cash flow management. Late payment of VAT to HMRC can result in surcharges and interest.

Understanding how output VAT fits into the broader input VAT vs output VAT framework helps businesses plan payments, manage working capital, and avoid unexpected liabilities.

Who Pays Input VAT vs Output VAT?

Understanding who pays input VAT vs output VAT helps clarify how VAT operates in practice within the UK tax system. Managing input and output VAT is an integral part of business operations and financial management, as businesses must track VAT paid on purchases and VAT collected on sales to optimize tax recovery and cash flow. Although VAT is charged at multiple stages of the supply chain, the economic burden ultimately falls on the end consumer.

VAT-Registered Businesses

VAT-registered businesses sit in the middle of the VAT system. They:

- Pay input VAT when purchasing goods or services for business use

- Charge output VAT when selling taxable goods or services to customers

Businesses use a VAT account to track input and output VAT amounts, ensuring accurate calculation of their VAT liability or refund entitlement.

The difference between input VAT vs output VAT determines whether a business owes VAT to HMRC or is entitled to a refund. Businesses do not usually bear the cost of VAT themselves, provided they reclaim input VAT correctly.

End Consumers

End consumers are not VAT-registered and cannot reclaim VAT. As a result, they ultimately pay the full VAT amount included in the price of goods or services. From HMRC’s perspective, VAT is designed so that the tax burden rests with the final consumer, not the business.

HMRC’s Role

HMRC collects VAT through VAT returns submitted by VAT-registered businesses. Businesses must submit periodic VAT returns to the tax authorities to report and remit VAT collected from customers. Businesses calculate their VAT liability by offsetting input VAT against output VAT and paying the net amount to HMRC or reclaiming any excess.

This flow of funds highlights the importance of correctly managing input VAT vs output VAT, as errors can directly affect compliance and cash flow.

Input VAT vs Output VAT – Key Differences Explained

The distinction between input VAT vs output VAT is at the core of the UK VAT system. While the concepts are closely related, they serve very different purposes in VAT accounting and reporting. Understanding these differences is essential for meeting VAT obligations and ensuring compliance with tax authorities. This knowledge helps businesses submit accurate VAT returns, avoid compliance issues, and manage their VAT liability effectively.

Core Difference Between Input VAT and Output VAT

The simplest way to understand input VAT vs output VAT is to look at the direction of the VAT flow:

- Input VAT is the VAT a business pays to suppliers on purchases

- Output VAT is the VAT a business charges to customers on sales

Input VAT represents potential VAT recovery, while output VAT represents VAT collected on behalf of HMRC.

Functional Comparison of Input VAT vs Output VAT

From a practical perspective, input VAT and output VAT differ in several important ways:

- Who charges it:Input VAT is charged by suppliers, whereas output VAT is charged by the business itself.

- Who receives it:Input VAT is paid to suppliers, while output VAT is ultimately paid to HMRC.

- Impact on VAT returns:Input VAT is deducted on the VAT return, while output VAT is declared as VAT due. The VAT return summarizes all the VAT charged on sales (output VAT) and all the input VAT incurred on purchases during the period, allowing businesses to calculate their total VAT liability by subtracting all the VAT paid on purchases from all the VAT collected from sales.

- Effect on cash flow:Input VAT can be reclaimed, improving cash flow, while output VAT must be paid to HMRC, reducing available funds.

These differences are fundamental when calculating VAT liability and assessing whether a business owes VAT or is due a refund.

Input VAT vs Output VAT on the VAT Return

On a UK VAT return:

- Total output VAT is reported as the sum of all VAT charged on sales during the accounting period.

- Total input VAT is reported as the sum of all VAT paid on eligible business expenses.

The difference between these two figures determines the amount payable to HMRC or reclaimable by the business. If total input VAT exceeds total output VAT, the business is in a VAT credit position and may claim a refund from HMRC. If output VAT is greater than input VAT, the business will have to pay the difference to the government. Accurate classification is essential, as HMRC frequently reviews VAT returns for errors relating to input VAT vs output VAT misreporting.

Common Misconceptions

A common misunderstanding is treating output VAT as business income or assuming all input VAT is recoverable. Both assumptions are incorrect and can lead to inaccurate VAT returns. Businesses must apply HMRC rules carefully to ensure that input VAT vs output VAT is reported correctly and consistently.

Why Understanding Input vs Output VAT Matters

Understanding input VAT vs output VAT is not just a technical requirement; it is essential for effective VAT management and overall business compliance in the UK. Understanding VAT purposes, including the different rates applied to various sales, is crucial for compliance and accurate VAT management. Businesses that clearly understand this distinction are better positioned to meet HMRC requirements, avoid penalties, and make informed financial decisions.

Accurate VAT Returns and Compliance

HMRC expects VAT-registered businesses to submit accurate and complete VAT returns. It is crucial for businesses to submit VAT returns correctly and ensure that all collected output VAT is accurately reported to avoid penalties or legal actions. Misclassifying input VAT vs output VAT is one of the most common reasons VAT returns are corrected or investigated. Even unintentional errors can result in interest charges or penalties, particularly where mistakes are repeated.

A clear understanding of input VAT vs output VAT helps ensure:

- VAT is charged at the correct rate

- Only eligible input VAT is reclaimed

- VAT returns reflect the true tax position of the business

This reduces the risk of HMRC enquiries and compliance issues.

Cash Flow and Financial Planning

VAT can have a significant impact on business cash flow. Output VAT collected from customers may be held temporarily before being paid to HMRC, while input VAT may be reclaimed after expenses are incurred. Poor understanding of input VAT vs output VAT can lead to cash flow shortages, particularly where VAT liabilities are underestimated.

Businesses that manage VAT effectively can:

- Forecast VAT payments accurately

- Avoid unexpected VAT bills

- Improve short-term liquidity

Strategic Tax and Business Decision-Making

VAT considerations often influence pricing, supplier selection, and expansion plans. Understanding input VAT vs output VAT allows businesses to assess the true cost of transactions and make tax-efficient decisions. This is particularly important for businesses dealing with mixed supplies, international trade, or complex VAT accounting schemes.

How to Calculate VAT Liability Using Input and Output VAT

Calculating VAT liability is one of the most practical applications of understanding input VAT vs output VAT. For UK VAT-registered businesses, VAT liability represents the net amount payable to HMRC or reclaimable at the end of each VAT accounting period. Tax liability in this context is defined as the amount of output VAT collected from customers reduced by the input VAT paid on qualifying purchases.

The basic VAT liability formula is straightforward:

Output VAT − Input VAT = VAT payable (or reclaimable)

To calculate VAT liability, businesses add up all the VAT charged on sales and deduct all the qualifying VAT paid on purchases.

If output VAT is higher than input VAT, the business must pay the difference to HMRC. If input VAT exceeds output VAT, the business is entitled to a VAT refund. This simple calculation underpins every UK VAT return and highlights why correct classification of input VAT vs output VAT is essential.

Step-by-Step VAT Liability Calculation

To calculate VAT liability accurately, businesses should follow these steps:

- Total all output VAT charged on sales during the VAT period

- Total all eligible input VAT paid on business expenses

- Subtract input VAT from output VAT

- Report the net figure on the VAT return

Each figure must be supported by valid records and VAT invoices to meet HMRC VAT rules.

Example of VAT Liability Calculation

Consider a UK VAT-registered consultancy during a quarterly VAT period:

- Output VAT charged on services: £18,000

- Input VAT paid on business expenses: £12,500

VAT liability calculation:

£18,000 − £12,500 = £5,500 payable to HMRC

This example demonstrates how the balance between input VAT vs output VAT determines whether VAT is owed or reclaimed.

When Input VAT Exceeds Output VAT

In some periods, particularly for start-ups or capital-intensive businesses, input VAT may be higher than output VAT. In these cases, HMRC will repay the difference after the VAT return is submitted, provided the claim is valid.

Impact of VAT Accounting Schemes

Different VAT accounting schemes affect how input VAT vs output VAT is recognised:

- Standard Accounting: VAT is accounted for based on invoice dates

- Cash Accounting Scheme: VAT is accounted for when payments are made or received

- Flat Rate Scheme: Input VAT recovery is limited, and VAT liability is calculated differently

Choosing the correct scheme can significantly affect VAT liability and cash flow.

Reclaiming VAT in the UK – Things to Remember

Reclaiming VAT is one of the main benefits of being VAT-registered, but it also carries compliance risks if handled incorrectly. A clear understanding of input VAT vs output VAT is essential when reclaiming VAT, as only eligible input VAT can be offset against output VAT on a VAT return.

Eligibility Criteria for Reclaiming VAT

To reclaim VAT in the UK, a business must:

- Be registered for VAT with HMRC

- Have incurred VAT on goods or services used for business purposes

- Hold valid VAT invoices or acceptable alternative evidence

VAT can only be reclaimed where it relates to taxable supplies. Businesses that make exempt supplies may have restricted or no entitlement to reclaim input VAT.

Time Limits for VAT Reclaims

HMRC imposes strict time limits on VAT reclaims:

- Goods: VAT can be reclaimed up to four years from the date of purchase

- Services: VAT can be reclaimed up to six months from the date of supply

Missing these VAT deadlines can result in lost VAT recovery, even where the expense would otherwise be valid.

Common VAT Reclaim Errors

Many errors arise from misunderstanding input VAT vs output VAT. Common mistakes include:

- Reclaiming VAT without a valid VAT invoice

- Reclaiming VAT on blocked items such as business entertainment

- Incorrectly reclaiming VAT on mixed-use expenses

- Claiming VAT at the wrong rate

Such errors increase the risk of HMRC enquiries and adjustments to VAT returns.

VAT Reclaims for International and Cross-Border Transactions

Businesses trading internationally must take extra care when reclaiming VAT. Import VAT, reverse charge VAT, and overseas VAT recovery all require correct treatment and documentation. Misclassification of input VAT vs output VAT in these cases can lead to underpaid VAT or rejected claims.

Importance of Accurate Records

Accurate record-keeping is critical to successful VAT reclaims. HMRC requires businesses to retain VAT records for at least six years. Proper documentation supports VAT claims and demonstrates compliance in the event of an audit.

Partner with Trusted Experts for Input VAT vs Output VAT Compliance

Understanding input VAT vs output VAT correctly is critical to maintaining HMRC compliance and protecting your business from costly errors, disputes, and investigations.

At The Taxcom, we provide expert-led accountancy and taxation services tailored to individuals and businesses across the UK. From VAT reviews and HMRC VAT investigations to complex tax enquiries, PAYE investigations, and serious matters such as CoP8, CoP9, and tax fraud, our experienced advisors offer clear guidance, strategic support, and complete peace of mind. Whether you need assistance with VAT calculations, reclaiming VAT, or managing an ongoing HMRC enquiry, our personalised approach ensures your financial affairs are handled with precision, discretion, and professionalism.

Get in touch today for a free consultation and ensure your VAT and tax compliance is in safe hands.