Understanding the 5 stages of a tax investigation helps you stay compliant and prepare you for any future challenges. This blog will be helpful, you feel less stressed and be ready to react properly. HMRC conducts tax inquiry to make sure people and businesses are following the protocol of law.

Even though getting a notice of an inquiry might be frightening. In This blog we will explore the complexities of the 5 stages of tax investigation, how you can prepare for each stage and what you should expect.

Introduction to 5 Stages of Tax Investigation

Navigating through a tax investigation can be a daunting experience for any individual or business. These enquiries seek to confirm that tax returns are accurate and taxpayers are fulfilling their responsibilities. Proactive approach and knowledge about investigations is essential. Otherwise, noncompliance might result in penalties.

Tax Investigations help to keep the system running by identifying the issues and preventing tax dodging. When you cooperate with HMRC and fix errors as soon as they appear, as a result you avoid unnecessary fines.

If you’re under an HMRC Tax investigation, it’s crucial to act quickly and effectively. At The Taxcom we can provide the guidance and representation you need to navigate through the process smoothly.

Why Tax Investigations Occur

Tax investigations occur for a variety of reasons. So, to understand 5 reasons of tax investigation you should know why tax investigations occur. Common triggers include:

Inconsistencies in tax returns: When your reported figures don’t match the records held by HMRC.

Odd trends in financial transactions: Your Large, unexplained deposits or withdrawals can raise red flags.

Incomplete or late filings: When your filing returns with missing information or late on a regular basis may draw attention.

Random selection: Some investigations are conducted at random as part of routine compliance checks.

Informers are the other reason for tax investigations who disclose possible fraud and suspicious conduct.

HMRC uses advance data analysis technologies to spot irregularities. This is the way to ensure equity and accountability in the tax system. Businesses with large cash transactions that are more likely to make mistakes. Also purposeful omissions are other causes for tax inquiries.

Although a tax inquiry may seem challenging, the right paperwork and the direction can amicably settle the cases. If you want your businesses to run smoothly without any legal intervention. This is where financial tax advisory comes in.

At The Taxcom our team provides comprehensive support for tax investigation disputes, compliance, and risk management, as well as assistance with tax appeals and bookkeeping.

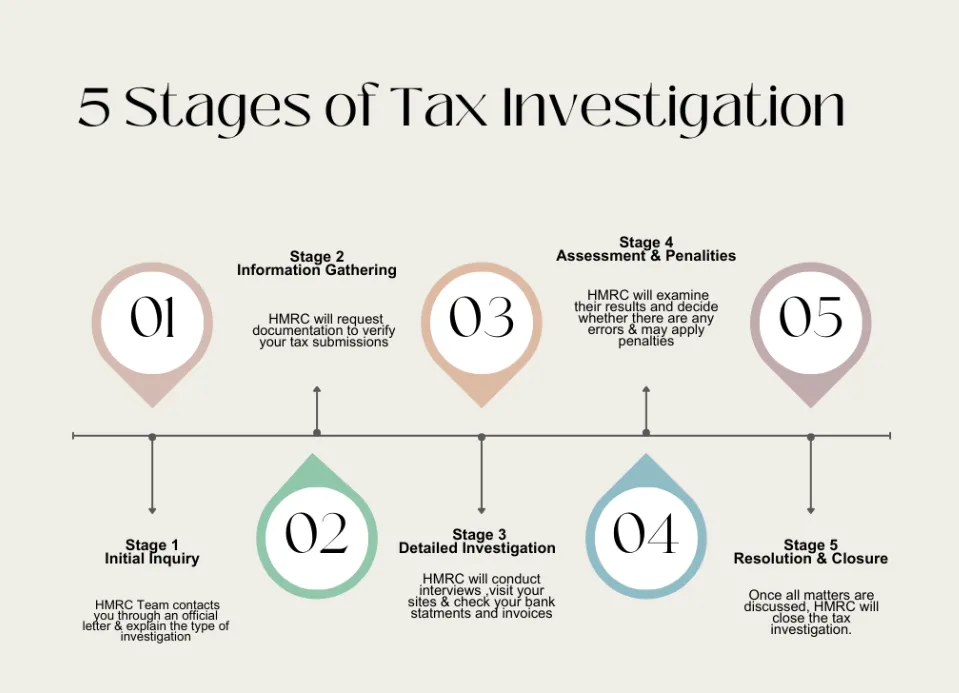

5 Stages of Tax Investigations Stage

Stage 1 : Initial Inquiry for tax investigation

The first stage of tax investigation begins when HMRC’s Investigation Team contacts you, usually through an official letter. This communication typically comes in the form of a letter informing you that your tax affairs are under review.

Furthermore, you may also receive details about the timeline and initial documentation required. It is crucial to remain calm, read the letter carefully, and get expert services in order to understand the extent of the tax investigation.

During this stage, understanding the 5 stages of investigation is very important. It can help you prepare relevant documents and avoid overcomplicating the process. For instance, an aspect inquiry may only need partial records, while a full tax investigation demands thorough documentation. Since ignoring or postponing responses worsen your situation. A quick action is essential at this stage.

It’s advisable to seek professional advice from a tax advisor or accountant to ensure that you provide the necessary information correctly and comprehensively. Consultation with The Taxcom services can help you manage the situation effectively.

Stage 2: Information Gathering during tax investigation

During this stage of tax investigation, authorities will request documentation to verify your tax submissions. These can include:

Bank statements: Your personal and business accounts to track transactions.

Business records: Invoices, receipts, and expense reports to validate claims.

Tax returns: Detailed records for specific years under investigation.

Providing accurate and complete records is essential to avoid further scrutiny. Some common challenges during this stage include:

Incomplete documentation: Missing records can delay the process or lead to fines.

Inconsistent information: Discrepancies between submitted and actual records.

Maintaining organized financial records is your best defense. Unnecessary problems can be avoided by proactively fixing any gaps or inaccuracies before submission. Routinely Checking your tax returns before filing can also reduce error risk. Professional accountant or using accounting software can help you make financial records accurate and up to date. At The Taxcom, we offer professional accounting services designed to help individuals and businesses maintain accurate and up-to-date financial records. Our team ensures compliance with tax regulations while minimizing the risk of errors and audits.

Stage 3: Detailed tax Investigation

HMRC’s next stage of tax investigation involves deeper into your financial activities. This stage often involves:

Cross-referencing records: HMRC matches your submissions against external data, such as bank statements and supplier invoices.

Conducting interviews: Key personnel, such as accountants or business partners, may take interviews from you and your staff to clarify uncertainties.

Site visits: For businesses, inspectors may visit premises to assess operations and records in person.

Among 5 stages of tax investigation, the detailed investigation phase usually takes time and causes stress . Common outcomes include:

- Identification of errors or discrepancies.

- Requests for additional explanations or supporting documents.

A proactive approach, such as reconciling records before submission and cooperating fully, can fast-track this phase. Investing in accounting software also prove beneficial for your company to keep your records error-free

Stage 4: Assessment and Penalties of tax investigation

In this stage of investigation, authorities will examine their results and decide whether there are any differences. If errors or unpaid taxes are found, they may apply penalties based on:

The Gravity of the problem: Serious penalties are frequently imposed for larger disparities.

Intentional or unintentional errors: Honest mistakes are treated more leniently compared to deliberate tax evasion.

Penalties can include:

- Financial fines.

- Interest on unpaid taxes.

- Legal action in extreme cases, such as fraud

In this situation your cooperation and openness is very important that might lessen the punishment. For instance, voluntary disclosure of errors frequently results in smaller fines than when HMRC finds inconsistencies.

At this point, compromise is essential. A knowledgeable Corporate tax advisory can make your case persuasively and possibly reduce fines. To show that you are prepared to follow, it is crucial that you communicate with HMRC in a professional and open manner.

Stage 5: Resolution and closure after tax investigation

In the last stage of tax investigation once all matters are discussed, HMRC will close the investigation. You will receive an issue of final assessment detailing:

Any additional taxes owed: Including interest and penalties.

Confirmation of compliance: If no further action is required.

Resolution timeline: Final steps to conclude the case.

A successful resolution often depends on proactive communication and professional advice throughout the process. Staying cooperative and organized ensures the investigation concludes without unnecessary complications. You can also hire someone for taxation services.

After the closure of the tax investigation, conduct a post investigation review to identify any process improvements and avoid future risks. Continuous monitoring of your tax processes can build long-term compliance.

For businesses, this is a good opportunity to revisit your financial practices. Ensure that your accounting systems, staff training, and tax filing processes are optimized for future compliance.

Types of HMRC Tax Investigations

Investigations authorities carry out different types of tax investigations to make sure that you are paying the right taxes. Depending on the degree of risk or suspicion, these investigations might range in intensity and depth.

Random Tax Investigation

In this type of investigation, enquiries are selected at random with no specific motivation and suspicion. HMRC conduct this investigation just to check that you are filling accurate tax returns and following the correct procedure.

They may ask you to provide supporting paperwork, such as bank statements, invoices, or receipts.

Aspect Tax Investigation

An aspect tax investigation is a focused examination of a certain section of a tax return, like deductions or business costs VAT. This typically occurs when HMRC finds a tax return that appears odd or inconsistent but does not think there is a serious problem.

HMRC may request you for the evidence, for instance, if your spendings are abnormally high in relation to your income. If mistakes are discovered, more taxes and fines need to be paid.

Full Tax Investigation

A full Tax investigation is a detailed and thorough review of your company’s entire financial records. HMRC may conduct this if they suspect significant errors, tax evasion, or fraudulent activity.

During a full investigation, HMRC will examine all sources of your income, bank transactions, invoices, payroll records, and past tax returns. These investigations can take months or even years to complete and may result in large tax bills, fines, or legal action.

Fraud Tax Investigation

Authorities in charge of tax investigations will start a fraud investigation if they think you have intentionally committed tax fraud. The Fraud Investigation Service (FIS) of HMRC is in charge of this kind of investigation, which is the most serious.

Complete monitoring, cautious interviewing, and even criminal prosecution are all part of fraud tax investigations. If you are guilty, there may be harsh penalties, such as heavy fines, asset seizures, and possibly jail time.

Strategies to Respond to a Tax Investigation

Handling a tax investigation requires a calm and methodical approach.

Here are some key strategies:

- Remain organized: Keep thorough records of all invoices, communications, and financial activities.

- Communicate Quickly: To prevent escalation, reply to HMRC’s questions within the given time frames.

- Seek Expert Assistance: Reducing potential liabilities and ensuring proper representation are two benefits of hiring a tax advisor.

- Be Transparent: Avoid making snap judgements or trying to cover up mistakes, too. Honesty and transparency are key to effectively resolving tax issues.

Educate your team: Additionally, in order to lower future risks, it is crucial to educate your workers or team on compliance.

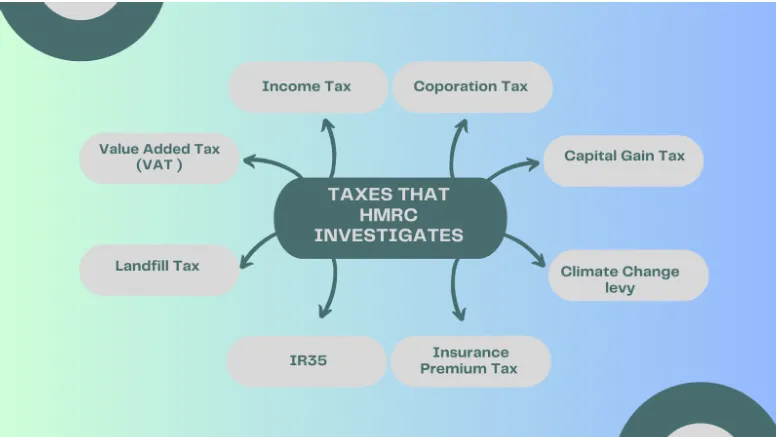

What Taxes does HMRC look into

HMRC investigates various type of taxes that include:

- Income tax

- Corporation Tax

- Value added Tax (VAT)

- Custom & excise Duties

- IR35

- Capital gain tax

Common Challenges During Tax Investigations

- Missing Records: Failure to produce requested documents can delay the investigation and increase penalties.

- Lack of Professional Representation: Without expert help, you may struggle to present their case effectively.

- Complex Financial Data: Misinterpretation of financial records can lead to unwarranted penalties or accusations

Preventing Tax Investigations

Prevention is always better than cure. Make sure you follow tax laws and regulations properly.

Consider this blog as learning opportunity and follow these tips to reduce your chances of investigation:

-

- File Accurate Returns: Ensure all tax returns are complete and error free.

- Maintain Proper Records: Use accounting software to organize financial data.

Work with Professionals: Regular consultations with tax advisors. Hey can help you identify and correct potential issues

Professional Help from The Taxcom

You don’t have to handle a tax investigation alone. Your case will be handled professionally and effectively if you work with knowledgeable tax advisors like the staff at The TaxCom. Professional advice is crucial for everything from record organization to negotiations with HMRC. Additionally, we offer business growth advisory and management accounting services to help clients achieve long-term success.

Contact The Taxcom we bring expertise, experience, and data-driven strategies to help you with your businesses achieve superior results.

Table of Content

Our Content Writing Team boasts a proven track record of crafting engaging and impactful content that drives success and achieves results.